When I first compared two companies—let’s call them Northbridge Industries and Eastridge Systems—they looked identical on paper.

Both posted a clean 20% Return on Equity.

Both were praised in the financial press.

Both sat comfortably inside the “high-quality” bucket most analysts love to create.

But one of them went on to build a decade of wealth.

The other quietly destroyed shareholder capital so efficiently that people who invested in it still avoid discussing it.

No scam.

No fraud.

No accounting scandal.

Just a number that hid more than it revealed.

That number?

ROE.

The most overrated metric in the investing world.

The truth is harsh: ROE can look brilliant even when a business is dying from the inside.

If you rely on ROE alone to judge a company, you are basically choosing a partner by looking at their Instagram profile.

Attractive on the surface, hiding chaos beneath.

ROE is the selfie.

DuPont is the X-ray.

And until you learn to look beneath ROE, you will keep falling for companies that shine just long enough to trap you.

Why ROE Misleads Even Smart Investors

At face value, ROE feels like the cleanest metric in finance.

Profit divided by equity.

Simple. Elegant.

Almost too elegant.

A beautiful ROE creates a psychological shortcut:

“High ROE = great company.”

But that shortcut is a trap.

ROE can be artificially inflated.

ROE can rise when profits don’t.

ROE can rise when the business weakens.

ROE can rise even when bankruptcy is around the corner.

Investors aren’t fooled by scams—they’re fooled by numbers that appear trustworthy.

And no number is more deceptive than ROE.

The Moment I Realised ROE Is a Mask

When I dug deeper into Northbridge and Eastridge, something shocked me.

Both companies produced similar ROE figures, yet their financial personalities—yes, personalities—were nothing alike.

Northbridge felt like a disciplined, consistent marathon runner.

Eastridge felt like a sprinter hopped up on borrowed adrenaline.

Northbridge wasn’t exciting.

It wasn’t flashy.

It just kept executing well, year after year.

Margins were strong, assets were productive, and debt was minimal.

Eastridge, on the other hand, was basically running a performance on borrowed time.

Weak margins.

Sluggish efficiency.

Debt stacked high enough to make even the lenders nervous.

But ROE masked all this because leverage artificially held the number up.

That’s the night I stopped trusting ROE—and started trusting the DuPont Breakdown instead.

The DuPont Formula: The Only Honest Interpretation of ROE

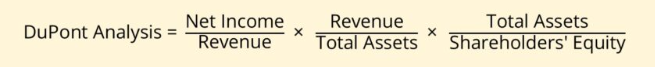

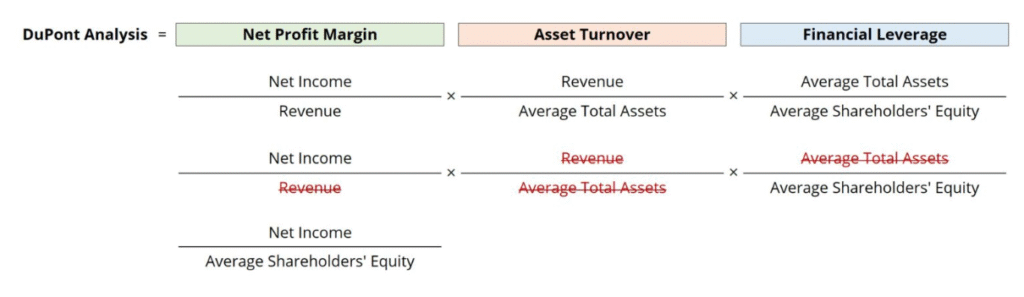

Let’s put this plainly.

ROE is the final score.

DuPont tells you how the score was achieved.

Three numbers.

Three drivers.

Three questions that reveal the true character of a company:

1. NET PROFIT MARGIN — How much do you actually keep?

This shows pricing power, competitive advantage, brand strength, and cost control.

2. ASSET TURNOVER — How efficiently do you use what you own?

This reveals discipline, operational intelligence, and the quality of management.

3. EQUITY MULTIPLIER — How much debt is amplifying (or faking) your returns?

This exposes risk appetite, fragility, and whether the business is borrowing its way to glory.

Put them together:

ROE = Margin × Turnover × Leverage

Three simple multipliers, but together they tell a story that ROE alone will never show you.

When the DuPont Breakdown Was Applied… the Truth Was Brutal

Northbridge’s 20% ROE came from high margins, decent asset efficiency, and low leverage.

It was the kind of return you can trust.

The kind that compounds quietly and doesn’t depend on the kindness of lenders.

The kind that survives recessions.

Eastridge’s 20% ROE came from weak margins, poor efficiency, and a massive amount of debt.

The business wasn’t strong—it was desperate.

Debt was the clutch holding the story together.

Take away the leverage and the ROE collapsed.

The same ROE number.

Two opposites.

Two futures that couldn’t be more different.

This is why DuPont ROE is not just a financial framework—

it’s a lie detector.

Margins: A Company’s Ego and Identity

Margins reveal whether a company has something special.

High margins mean the business sells value, not just products.

Strong brand, differentiated offering, customer trust—these are things money can’t fake.

Northbridge had margins that were boringly stable.

That stability is a sign of deep-rooted competitive advantage.

Eastridge had shrinking margins.

The kind that hint at panic—discounting, promotional pushing, deteriorating product strength.

A shrinking margin is the first crack in the armor.

Asset Turnover: Discipline That Separates Winners from Pretenders

Turnover tells you how well a company uses what it owns.

It is a handwriting sample of management skill.

Northbridge used its assets like a well-tuned engine.

Inventory was efficient.

Plants weren’t idle.

Every rupee of capital earned its keep.

Eastridge, in contrast, built assets like someone building an empire for vanity.

Excess factories, excess inventory, slow-moving stock.

A classic case of expansion without purpose.

Turnover is where pretenders get exposed.

If assets don’t generate revenue, they’re not assets—they’re dead weight.

Leverage: The Silent Danger Behind “Great” ROEs

This is where most people get fooled.

If a company wants higher ROE, it can simply borrow more money.

Debt reduces equity, and suddenly ROE magically jumps—without any improvement in business quality.

Northbridge kept leverage low.

It relied on performance, not financial engineering.

Eastridge used debt like makeup.

Heavy layers, hiding the true face.

This is how companies die suddenly: their returns look strong until the day lenders stop cooperating.

Leverage can make weak companies look brilliant—right before collapse.

Why Investors Should Fear Rising ROE

Yes, you read that correctly.

A rising ROE is dangerous when:

- Margins aren’t rising

- Turnover isn’t rising

- But leverage is

It means the company is taking shortcuts.

It means returns are being borrowed, not earned.

It means risk is exploding while investors clap.

This is how investors get blindsided.

DuPont ROE Is Not Just a Framework — It’s a Personality Test

Margin = confidence

Turnover = discipline

Leverage = risk appetite

When you analyze a company through these three traits, you stop looking at it as a stock.

You start seeing it as a character—one capable of growth, fear, or self-destruction.

Northbridge was a disciplined operator.

Patient. Efficient. Confident.

Eastridge was an insecure sprinter.

Borrowing speed. Faking performance.

Impressive right up until the fall.

The Collapse Was Inevitable

When the market slowed down and Eastridge lost pricing power, the debt became unbearable.

Margins cracked, turnover fell further, and ROE disappeared overnight.

Northbridge barely flinched.

It had strength built from fundamentals, not leverage.

Same ROE at the start.

Opposite outcomes in the end.

This is why DuPont ROE is non-negotiable for investors.

It reveals what numbers try desperately to hide.

The Final Word

Two companies can show the same ROE.

Only one deserves your money.

Because ROE tells you the return.

DuPont tells you the truth.

Three numbers—

Margin, Turnover, Multiplier—

are all you need to know whether a company is:

- a compounding machine

- a risk addict

- a weakling masquerading as a performer

- or a fragile empire built on debt

Once you learn to see companies through DuPont, investing becomes clear.

You stop guessing.

You start understanding.

If you found this breakdown useful, you’ll definitely want to read my previous piece—“Retail Investors Are Asking the Wrong Question About Nvidia — Here’s the Right One”—where I unpack the one question Buffett uses to cut through market noise.

Harsh is the creator of Dalal Street Lens, where he writes about investing, market behaviour, and financial psychology in a clear and easy way. He shares insights based on personal experiences, observations, and years of learning how real investors think and make decisions.

Harsh focuses on simplifying complex financial ideas so readers can build better judgment without hype or predictions.

You can reach him at imharshbhojwani@gmail.com

More from Dalal Street Lens

Most Investors Misread Accent Microcell. This Is the Real Business.

Most Investors Misread Accent Microcell. This Is the Real Business. Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In

Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In McDonald’s Business Model Explained: Why It’s Not Really About Burgers

McDonald’s Business Model Explained: Why It’s Not Really About Burgers Jesse Livermore Lessons

Jesse Livermore Lessons Karnataka Bank Earnings Call Analysis – November 2025

Karnataka Bank Earnings Call Analysis – November 2025 How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets

How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets Retail Investors vs Institutional Investors

Retail Investors vs Institutional Investors Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way

Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way Cost Structure Is Destiny

Cost Structure Is Destiny The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India

The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India

Pingback: Why Are Countries Buying Gold… and Why India Is Doing It Faster? - Dalal Street Lens