Disclaimer:

This article is for educational and informational purposes only. The stocks and companies discussed here are not buy or sell recommendations. Investors should conduct their own research or consult a qualified financial advisor before making any investment decisions.

In 2021, Indian footwear stocks looked unstoppable

Relaxo. Bata India. Campus. Metro Brands.

Different price points. Different customers.

But the same stock chart: a steep climb.

Everything looked perfect.

Consumption was booming, athleisure became a lifestyle, casualisation was the new normal, and the market genuinely believed footwear was becoming the next FMCG-style compounder.

Then, almost in sync, every footwear stock rolled over.

Not because of scandals.

Not because sales collapsed.

Not because India stopped wearing shoes.

Footwear stocks fell because investors misunderstood the cycle.

And what looked like a structural “superstory” in 2021 was simply a temporary demand spike + margin squeeze + expectation reset.

Let’s break it down in the simplest, sharpest way possible.

Section 1: What investors believed in 2021 (and why it actually made sense)

2021 wasn’t a hallucination.

The footwear bull run had solid logic behind it.

1. People were staying home → slippers, sandals, casual shoes boomed

Home-wear and athleisure were the stars of 2020–21.

2. Organized retail looked like it was winning

More consumers were buying branded shoes.

More Tier-2 and Tier-3 families were upgrading.

3. The market believed this was permanent

Cheap liquidity.

Low interest rates.

India-consumption-mania.

Everything combined into a perfect narrative.

But here’s the twist:

The narrative wasn’t wrong, the timeline was.

Section 2: The demand didn’t disappear, it simply came early

This is the core insight investors miss.

Footwear demand did not collapse after 2021.

Consumption was not dying.

People did not become anti-shoe.

What actually happened?

People bought 2–3 years worth of footwear inside one year.

Because:

- Lockdowns ended

- Travel exploded

- Offices reopened

- Weddings, gatherings, festivals returned

- Fitness and walking trends spiked

The replacement cycle got compressed.

Footwear normally has a 2–3 year life.

So if India bought heavily in 2021–22, what happens in 2023–24?

Nothing.

Quiet.

Silence in the demand curve.

Not because of weakness…

…but because shoes don’t evaporate every six months.

Shoes last. Demand doesn’t repeat until they break.

2021–22 = Buying

2023–24 = Digestion

This alone explains 60% of the post-2021 slowdown.

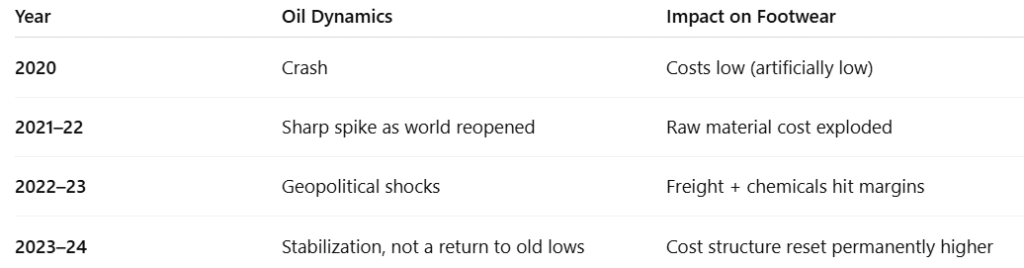

Section 3: The silent villain, crude oil

Most investors never connect footwear with global oil markets.

But footwear is an oil business in disguise.

Shoes = Oil

Look at what goes into footwear:

- EVA, PU soles → crude derivatives

- Foam cushioning → crude

- Synthetic uppers → crude

- Adhesives → crude

- Packaging → crude

- Transportation → diesel/oil

Crude impacts almost everything in a shoe.

What happened after COVID?

Footwear companies faced a nightmare:

Raise prices → consumers postpone

Don’t raise → margins collapse

This explains another 30% of the damage.

Section 4: Why footwear is the easiest category to postpone

Now the psychology.

Why can consumers delay footwear purchases so easily?

1. Shoes don’t expire

Milk expires.

Medicines expire.

Shoes don’t.

2. Shoes can be repaired

Sole repair.

Stitching.

Glue jobs.

3. No penalty for waiting

Unlike phones, medicines, or rent…

Postponing footwear doesn’t disrupt life.

4. Inflation made people conservative

2022–24 inflation hit household budgets.

Consumers stopped discretionary upgrades.

This creates a unique problem:

Demand never collapses — it simply drifts.

This kind of drift destroys investor patience.

And stock prices.

Section 5: Why stocks fell even without bad news

This is the most important investor lesson.

Stocks don’t fall because companies collapse.

Stocks fall because expectations collapse.

In 2021 the market said:

“Footwear is a structural growth story.”

By 2022 the market said:

“Footwear is a normal business with volatile margins.”

That shift in perception is enough to derate a whole sector.

You don’t need a disaster.

You just need disappointment.

Footwear delivered disappointment, not disaster.

But markets punish disappointment harder.

Section 6: Distribution vs Brand, the real strategic truth

Retail investors often think brand is everything.

But in early-cycle recovery, distribution beats brand every single time.

Because:

Replacement is an urgent purchase.

When someone’s shoe tears, they buy:

- What’s nearby

- What’s available

- What’s within budget

They don’t browse Pinterest.

They don’t wait 3 days for online delivery.

Offline still dominates Tier-2/3 India

Yes, online exists everywhere.

But urgent buying is offline-first.

Which companies does this favor?

High distribution players:

- Bata India

- Relaxo

These companies are built for:

- Mass availability

- Quick replacement

- Trust-based buying

Metro & Campus are strong brands —

but brand helps later, not first.

Section 7: “But online is everywhere now — why does distribution still matter?”

A logical question.

But here’s the reality:

Online = planned purchases

Offline = urgent purchases

Footwear replacement is urgent.

What stops people from buying shoes online?

- Size uncertainty

- Fit issues

- Return hassle

- Delayed availability

If your slipper breaks, you don’t wait for delivery.

You walk to the nearest store.

This is why distribution remains king despite digital adoption.

Section 8: When does footwear buying shift from “urgent” to “considered”?

This is the TRUE turning point of the cycle.

Replacement becomes considered only when:

- Inflation fear fades

- Salaries rise

- People feel financially safe

- They start upgrading, not replacing

This is when:

- ASPs rise

- Premium SKUs move

- Metro & Campus see better traction

- Margins expand

That phase is coming, but not yet fully here.

Section 9: When will the replacement cycle restart?

Realistic, not optimistic answer:

Late 2025 to 2026.

Why?

Heavy buying happened in:

- 2021

- Early 2022

Footwear life:

- 1.5–2 years for sports/casual

- 2–3 years for slippers/sandals

Add economic stress & postponement → cycle shifts right.

The next genuine replacement wave begins in late 2025.

Market will move before you see this in earnings.

Section 10: Which companies survive even if recovery delays?

This is the question 99% of investors ignore:

Who survives comfortably even if the cycle takes longer?

The strongest footwear companies have:

- Strong balance sheets

- Wide distribution

- Controlled inventory

- Ability to protect margins

These companies do NOT need a massive boom to recover.

They simply need normalization.

The weak players?

They need a miracle.

Section 11: A simple investor framework you can use

Early Cycle

- Distribution > brand

- Volumes > margins

- Value > premium

- Replacement > fashion

Mid Cycle

- Margins normalize

- Brand recall improves

- Premium SKUs rise

- Online channels grow faster

Late Cycle

- Premiumization becomes the story

- Market rerates branded players

- Valuation expansion happens

Your biggest mistake today would be:

Buying late-cycle stocks in an early-cycle environment.

FAQs investors are asking

1. Is the Indian footwear sector broken?

No. It’s in a normalization phase, not a structural decline.

2. Will oil price reduction revive footwear stocks?

It helps margins but does NOT revive demand alone.

3. Is this a value trap?

Depends on the company.

Balance sheet + distribution = survivors.

Weak brands + weak reach = risk.

4. Why did all stocks peak at the same time?

Because the cause was macro: pulled-forward demand + inflation, not company-level issues.

5. Which companies benefit first from recovery?

Mass-distribution players (Bata, Relaxo type).

Premium players (Metro, Campus) benefit later.

Conclusion: The footwear cycle didn’t break — expectations did

Footwear stocks didn’t fall because India stopped walking.

They fell because:

- Demand came early

- Margins got squeezed

- Investors assumed the boom was permanent

Footwear is a simple business with a complicated cycle.

Shoes get replaced when they die — not when investors want them to.

And millions of shoes bought in 2021–22…

are only now approaching their final breath.

The next cycle won’t scream.

It will begin quietly.

Just like all real opportunities.

If you liked this blog, you might enjoy my previous ones as well:

👉 Why Cheap Stocks Trap You — The Psychology Behind It

👉Why Nifty Is at All Time Highs but Your Portfolio Is in the Basement

👉AI Won’t Crash Like 2000. It Might Correct Like 2008 — When Reality Finally Shows Up.

👉Strong USD Is Not a Modi Issue or a Congress Issue — It’s Global

👉 Why We Feel Smarter After a Stock Falls: The Psychology of Market Regret

👉 Why Comparing Your Portfolio to Others Destroys Your Returns

👉Is Your Stock a Hidden Pump-and-Dump?

Harsh is the creator of Dalal Street Lens, where he writes about investing, market behaviour, and financial psychology in a clear and easy way. He shares insights based on personal experiences, observations, and years of learning how real investors think and make decisions.

Harsh focuses on simplifying complex financial ideas so readers can build better judgment without hype or predictions.

You can reach him at imharshbhojwani@gmail.com

More from Dalal Street Lens

Most Investors Misread Accent Microcell. This Is the Real Business.

Most Investors Misread Accent Microcell. This Is the Real Business. Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In

Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In McDonald’s Business Model Explained: Why It’s Not Really About Burgers

McDonald’s Business Model Explained: Why It’s Not Really About Burgers Jesse Livermore Lessons

Jesse Livermore Lessons Karnataka Bank Earnings Call Analysis – November 2025

Karnataka Bank Earnings Call Analysis – November 2025 How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets

How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets Retail Investors vs Institutional Investors

Retail Investors vs Institutional Investors Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way

Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way Cost Structure Is Destiny

Cost Structure Is Destiny The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India

The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India