India is sprinting into a decades-long data-centre supercycle. We’re short on capacity, long on data, and being chased by hyperscalers and AI workloads that need power, space and specialized hardware (GPUs). Expect 3 GW of capacity by 2030 (and some forecasts go even higher), a public cloud market growing at 20%+ CAGR, and hyperscalers pouring tens of billions into India. This is infrastructure, not hype — but it’s capital-intensive, politically sensitive, and ugly to build.

Why you should care

Ask yourself: when you scroll a reel, pay with UPI, or ask ChatGPT for a recipe, where does that work happen? Not in your phone. It happens in industrial buildings humming with machines that have become the unglamorous backbone of the digital age. India’s appetite for those buildings is growing faster than we can build them. That gap is the supercycle.

1) The problem in one sentence

India produces more data, but our data-centre capacity is still catching up — and AI makes the gap much worse. According to industry reports, India’s installed data-centre capacity rose from roughly 575 MW in 2021 to ~1.5 GW by 9M-2025, and is projected to hit ~3 GW by 2030 (with some estimates even more aggressive).

Why that matters

More data = more storage + compute.

More compute (esp. AI) = more power per rack (10× density for GPU racks vs a normal rack).

More power + density = more sophisticated, expensive DCs.

Translate that into money: institutional reports and media coverage point to a multi-billion dollar investment pipeline (hundreds of thousands of crores).

2) What data centres actually do

Data centres provide three things:

Compute — CPUs/GPUs running apps, models, transactions.

Storage — everything from your cat photos to transaction ledgers.

Connectivity — fiber networks, routes, and peering so packets reach the right app in milliseconds.

If compute is the brain, storage is the memory, and connectivity the nerves — data centres are the skull, spine and arteries that keep the organism alive.

3) The two business models you must know: Colo vs Cloud (and why the difference matters)

Short version: colo = you own the servers, cloud = the provider owns them. Same building, different business model.Your Attractive Heading

Colo (colocation)

The data-centre operator sells space, power, cooling and interconnects.

Customers bring their own servers.

Good for predictable, high-volume, latency-sensitive workloads (banks, exchanges, telecom, AI labs).

Upfront: customers take capex. Provider is landlord + utility operator.

Cloud (IaaS/PaaS/SaaS)

The provider buys the servers, runs the control plane, sells compute/storage as a service.

Good for scalability, speed, and unpredictable workloads.

Provider takes huge upfront capex and builds software to automate everything.

Both exist in the same ecosystem — but their economics, stickiness and returns are very different. (We’ll compare ROE and costs later.)

4) The five pillars of the supercycle (a simple framework you can use forever)

1. Data creation — UPI, OTT, 5G, IoT, GCCs produce raw demand.

2. Cloud adoption — enterprises shifting workloads to cloud platforms.

3. Data-centre build-out — colo + hyperscale campuses + edge nodes.

4. AI compute — high-density GPU clusters changing the economics.

5. Policy & power — localisation rules (DPDP) and stable electricity make or break projects.

5) Five hard numbers you need to know

1. Current capacity ~1.5 GW (9M-2025) — India’s capacity grew rapidly from 575 MW (2021) to ~1.53 GW (9M-2025).

2. Projected capacity ~3 GW by 2030 (Avendus/IBEF) — several industry reports forecast near doubling to 2030.

3. Indian public cloud market ~22–23% CAGR (2024–29) — IDC and other analysts estimate ~22.6% CAGR to 2029. (Public cloud could be a $30B market by 2029.)

4. Hyperscaler commitments are enormous — Amazon/AWS, Microsoft, and Google have announced multi-billion dollar investments in India (e.g., Amazon’s expanded commitments and large multi-billion plans). These anchor long-term demand.

5. GPU deployment accelerating — market surveys and company disclosures point to tens of thousands of GPUs deployed/planned in India (AI clusters, H100/H200 orders), lifting DC power density demands.

6) The economics: capex, ROE and stickiness (the investor’s view)

This is the part where most people get woozy. I’ll keep it crisp.

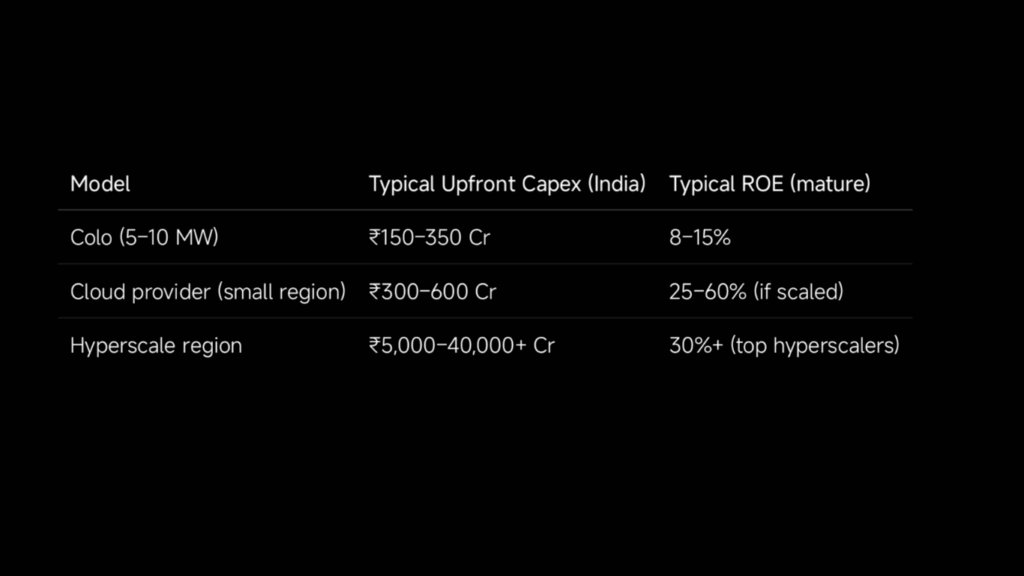

Upfront capex to build (rough ballpark)

Small to mid data centre (5–10 MW): ₹150–350 crore.

Hyperscale region (30–50 MW): ₹500–1,500+ crore and above (varies by land, power and cooling tech).

Build a cloud provider (customer-facing, software + infra): hundreds to thousands of crores; hyperscale regions cost tens of thousands of crores globally.

ROE and margins

Colo sells space+power → utility-like ROE (~8–15% mature).

Cloud sells software + services → software-like ROE (25–60% in mature hyperscalers). Cloud wins on margins and compounding but needs massive scale. (This is why AWS/Azure/GCP dominate.)

Stickiness: cloud > colo

Colo lock: physical migration pain, sunk capex.Cloud lock: architectural lock-in, data gravity, proprietary managed services. Cloud is stickier and more lucrative. (You already knew this — now it’s backed by market behaviour.)

AI changes everything — here’s how

AI workloads change the unit economics:

Power density: GPU racks draw 3–10× power compared to CPU racks. That forces different cooling (immersion, liquid), different PDU & generator sizing.

Revenue per MW: AI customers pay a premium for GPU time — higher ARR per rack can offset the higher capex.

Supply chain: GPUs (H100/H200) are scarce and expensive; owning GPU inventory is capital-intensive and risky. But it’s a moat if you can provide large-scale GPU pools.

Case in point: Indian operators and cloud players are buying tens of thousands of GPUs to offer local AI training/inference — that’s a structural demand spike for high-density DCs.

8) Policy and localisation — the invisible accelerator

India’s DPDP rules and sectoral guidelines (RBI, MeitY) increase demand for local storage and processing — i.e., more domestic data centres. The DPDP framework and associated rules tighten the preference for local hosting in some sensitive sectors, which benefits Indian DC and cloud providers.

9) Risks you cannot ignore (and how to watch them)

Overbuild & vacancy: Herd behaviour can lead to too much supply. Look at utilisation/commitment rates and pre-lets. Reuters and industry players worry about overcapacity if everyone builds aggressively.

Power constraints: Availability, cost, and renewables mix matter — GPUs need stable, cheap electricity.

Regulation ambiguity: Data localisation rules can change; political risk is real.

GPU supply & export controls: Geopolitics or supply shocks can choke AI infra plans.

Execution & financing: These are capex-heavy businesses; interest rates and credit availability matter.

Actionable investor checklist

1. MW/GW capacity additions in Mumbai, Hyderabad, Bengaluru and Chennai (monthly).

2. Occupancy / pre-let rates for new DCs (quarterly).

3. Hyperscaler capex announcements in India (newswatch).

4. GPU orders / H100/H200 counts per operator (PRs/filings).

5. PUE and renewable energy mix reported by operators.

6. ARRs (revenue per rack / per kW) — higher for AI customers.

7. Debt / leverage on operator balance sheets.

8. State incentives and land-acquisition status.

9. DPDP & sectoral compliance updates.

10. Local power tariff trends (state DISCOMs).

11. Supply chain news: Nvidia, AMD, Intel availability.

12. M&A and PE activity in the DC sector (signals of consolidation).

FAQs (based on actual search intent)

Q: How much data centre capacity does India have today?

A: Roughly ~1.5 GW as of 9M-2025; forecasts point to ~3 GW by 2030 depending on demand and projects.

Q: Is building a cloud in India cheaper than in Singapore?

A: Land and construction costs in India are generally lower, but total costs depend on power, connectivity, tax incentives and scale. India’s lower land/power costs are a competitive advantage, but hyperscale still costs billions.

Q: Will AI alone justify new data centres?

A: AI is a high-value incremental demand driver — GPUs increase power density and revenue per MW, making new AI-ready DCs economically attractive. But AI is not the only driver; cloud and localisation also matter.

Q: Which Indian listed stocks give direct exposure?

A: Sify, E2E Networks, ESDS and larger players like Tata Communications and Airtel (Nxtra) provide exposure; the pure-play list is small.

India’s data-centre supercycle is real because the country’s data creation, cloud adoption and AI demand are compounding faster than capacity — but building this future requires patient capital, reliable power, smart regulation and a sober approach to avoid herd overbuild.

Harsh is the creator of Dalal Street Lens, where he writes about investing, market behaviour, and financial psychology in a clear and easy way. He shares insights based on personal experiences, observations, and years of learning how real investors think and make decisions.

Harsh focuses on simplifying complex financial ideas so readers can build better judgment without hype or predictions.

You can reach him at imharshbhojwani@gmail.com

More from Dalal Street Lens

Most Investors Misread Accent Microcell. This Is the Real Business.

Most Investors Misread Accent Microcell. This Is the Real Business. Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In

Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In McDonald’s Business Model Explained: Why It’s Not Really About Burgers

McDonald’s Business Model Explained: Why It’s Not Really About Burgers Jesse Livermore Lessons

Jesse Livermore Lessons Karnataka Bank Earnings Call Analysis – November 2025

Karnataka Bank Earnings Call Analysis – November 2025 How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets

How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets Retail Investors vs Institutional Investors

Retail Investors vs Institutional Investors Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way

Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way Cost Structure Is Destiny

Cost Structure Is Destiny The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India

The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India