By Harsh Bhojwani

🌍 The Shift: From Infection to Lifestyle

For decades, India’s healthcare battle was fought against infections.

Today, the enemy has changed — and it wears a suit and sits in an office chair.

Heart disease, diabetes, hypertension, and obesity now account for more than two-thirds of India’s deaths.

Between 1990 and 2016, cardiovascular disease (CVD) cases more than doubled, and CVD-related deaths rose from 2.1 million in 2015 to 2.9 million in 2021, a 5.3 % CAGR.

If this trajectory holds, India will cross 4.5 million CVD deaths annually by 2030.

🌿 Ayurveda’s Second Act

Ayurveda is no longer a fringe wellness label.

It’s being recast as a credible partner in chronic-disease management, powered by policy, consumer, and global tailwinds.

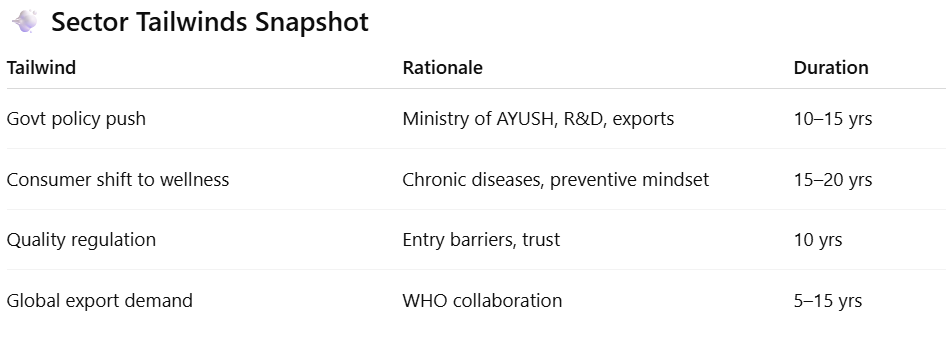

1️⃣ Government & Policy Support

- Ministry of AYUSH investment push: market size from US$18 bn (2021) → US$43 bn (2024) → US$200 bn by 2030

- Schemes & incentives: export promotion, R&D funding, start-up recognition

- AI digitisation & regulation: quality standards and pharmacopoeia digitisation improve transparency

🕒 Tailwind duration: 10–15 years — structural, not cyclical.

2️⃣ Cultural Acceptance

Nearly 45 % of urban and 40 % of rural Indians used an AYUSH-based remedy in 2022–23.

Consumers now prefer natural yet data-backed healing — the exact positioning Ayurveda 2.0 occupies.

3️⃣ Global Ambition

India has signed WHO and bilateral AYUSH partnerships, positioning itself as a global traditional-medicine hub.

Export momentum expected to last another decade or more.

🏥 The Company: Madhavbaug (Vaidya Sane Ayurved Laboratories Ltd)

Madhavbaug focuses on reversal therapies for cardiac, diabetic, and metabolic disorders, operating:

- 333 clinics (owned + franchise)

- 4 hospitals (Khopoli, Nagpur, Vadodara, Visakhapatnam)

- 2 manufacturing units (Ayurvedic medicines & nutraceuticals)

Its revenue model is a mix of services and products, while its “MIB Pulse” app extends patient engagement digitally.

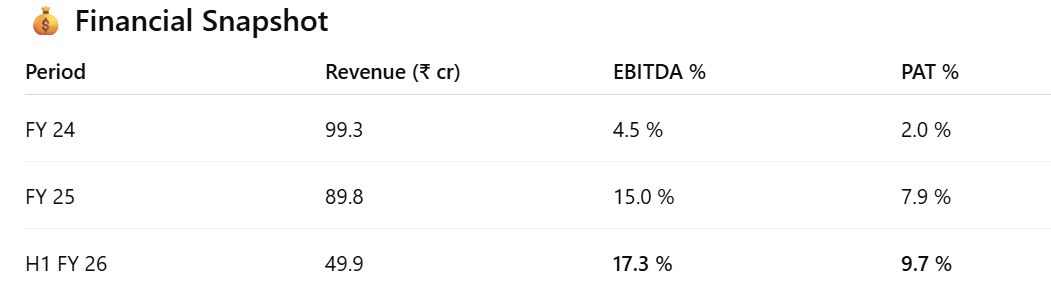

Margins have expanded sharply even amid flat revenue — signalling cost discipline.

Madhavbaug remains debt-free, funding growth internally.

🌏 Market Opportunity

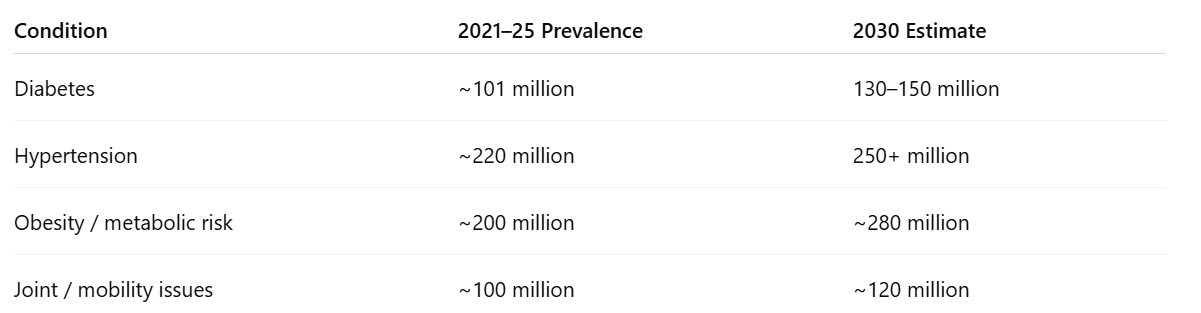

India’s chronic-disease population (≈ 300 mn) × average spend (₹ 20 k/year) =

a ₹ 2 trillion (~US$ 240 bn) total addressable market by 2030.

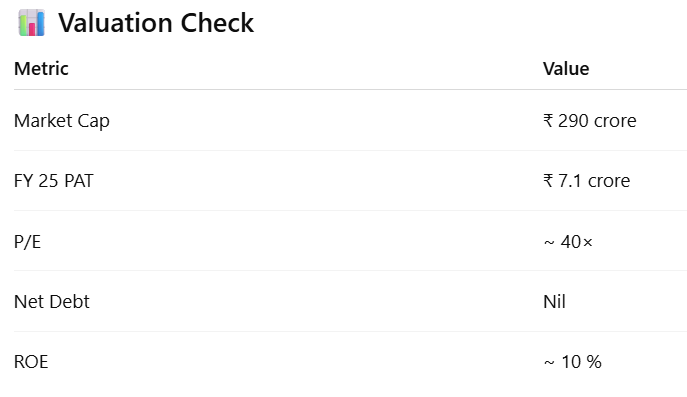

At a ₹ 290 cr market cap, the company currently captures 0.014 % of this universe.

Even a 0.1 % capture (₹ 2,000 cr revenue) could justify a ₹ 5,000 cr valuation.

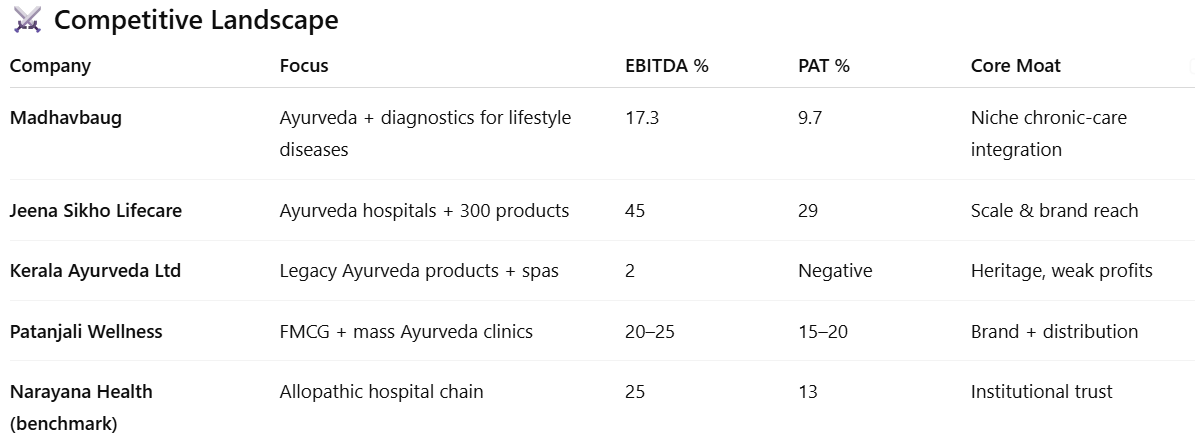

Madhavbaug stands between FMCG Ayurveda and allopathic hospitals, owning a “therapeutic Ayurveda” niche but lacking brand scale.

Rerating potential exists, but only if growth resumes and outcomes gain validation.

🔮 Analyst’s View

Demand: Structural and rising.

Balance Sheet: Strong and conservative.

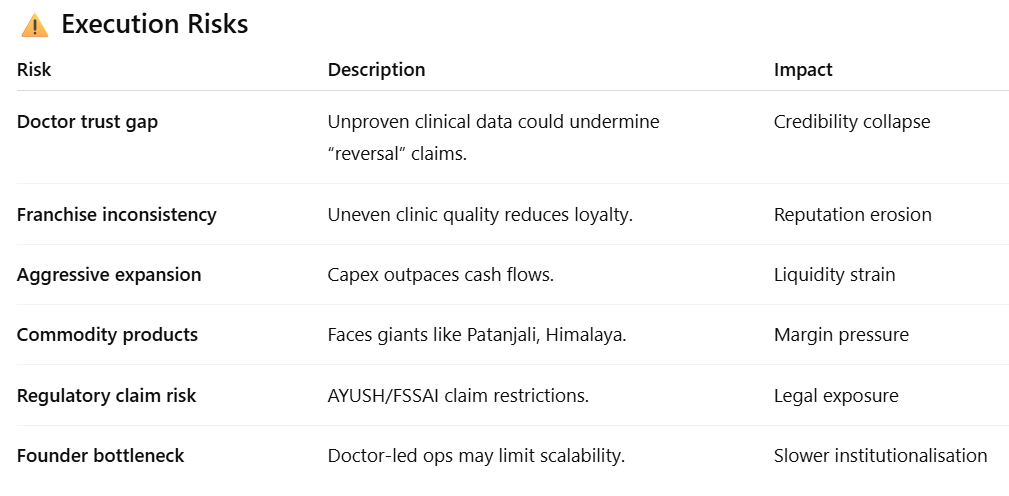

Execution Risk: Medium-high.

Valuation: Moderate optionality; long runway.

Madhavbaug isn’t fighting to prove Ayurveda’s relevance — that war is already won. Its next battle is credibility, consistency, and scale.

If it can professionalize its network, maintain > 15 % margins, and publish credible outcome data, it could evolve from a ₹ 290 cr niche to a ₹ 5,000 cr compounder by the next decade.

🧠 Key Takeaway

India’s chronic-disease epidemic has created a trillion-rupee opportunity.

Ayurveda 2.0 — scientific, structured, and data-driven — will define the next decade.

Madhavbaug is one of its earliest organised bets.

More from Dalal Street Lens

Most Investors Misread Accent Microcell. This Is the Real Business.

Most Investors Misread Accent Microcell. This Is the Real Business. Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In

Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In McDonald’s Business Model Explained: Why It’s Not Really About Burgers

McDonald’s Business Model Explained: Why It’s Not Really About Burgers Jesse Livermore Lessons

Jesse Livermore Lessons Karnataka Bank Earnings Call Analysis – November 2025

Karnataka Bank Earnings Call Analysis – November 2025 How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets

How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets Retail Investors vs Institutional Investors

Retail Investors vs Institutional Investors Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way

Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way Cost Structure Is Destiny

Cost Structure Is Destiny The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India

The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India