When a mid-cap defence manufacturer builds faster than its ecosystem evolves, execution becomes the real battlefield.

By Harsh Bhojwani

In Mani Ratnam’s Guru, *Gurukant Desai’s empire rises faster than the system around him. His ambition bends rules, his speed outpaces discipline, and his story becomes both inspiration and caution.

Apollo Micro Systems feels like it’s living a similar script today — a company with real technology, real demand, and real ambition — but operating inside a system that moves far slower than its dreams.*

When Conviction Meets Constraint

Apollo Micro Systems’ Q2 FY26 commentary was rich with conviction.

8× capacity expansion. Record quarterly revenue. Record margins. A ₹250 crore capex fully underway.

Management spoke with the swagger of a company ready to graduate from being a subsystem vendor to a full-scale defense manufacturer.

But if you listened closely, the story that emerged wasn’t one of unqualified strength — it was of a company trying to run a marathon inside a bureaucratic maze.

Working Capital — The Structural Constraint

Most analysts see Apollo’s ₹360 crore receivables and ₹600 crore inventory and call it poor working capital management.

That’s half right.

In defence, receivables don’t move like invoices — they move like files.

DRDO and MoD contracts are milestone-based: design approval → field trials → user acceptance → payment release.

That process easily spans 9–12 months.

Apollo’s heavy working capital isn’t pure mismanagement — it’s a byproduct of building in a system that still runs on clearance letters and technical validation cycles.

But where Apollo goes wrong is in layering fresh capex on top of this structural lag.

Building Unit 3 with such liquidity stress means they’re betting that the future will pay for the present.

That’s ambition with a timer attached.

₹250 Crore Capex — The Expansion Paradox

The upcoming “Unit 3” facility is meant to be Apollo’s leap from ₹400 crore to ₹1,000 crore revenue potential.

Capex: ₹250 crore.

Management says it’ll be funded “mostly through internal accruals and some working capital loans.”

That sounds safe — until you remember that internal accruals are profits that haven’t yet turned into cash.

Banks remain reluctant to provide long-term project financing to private defence firms, since much of the equipment is bespoke and lacks standard resale value.

So companies like Apollo end up financing long-term assets through short-term credit — not by choice, but by constraint.

It’s a common industry workaround.

But it’s also why execution risk and liquidity risk rise together.

A small delay in project commissioning or receivable collection can squeeze both operations and expansion at once.

Internal Accruals — Hope as a Funding Source

In theory, “internal accruals” means funding growth from your own profits.

In practice, it assumes that those profits are cash profits.

Apollo’s operating cash flow has historically trailed its PAT — sometimes sharply — which means much of its profit is tied up in receivables.

So when management says “internal accruals,” what they really mean is “expected inflows.”

That’s not deceit; it’s optimism in accounting form.

The risk, however, is mathematical: you can’t build a ₹250 crore factory with ₹20 crore in cash and hope the rest arrives on schedule.

The Promoter Pledge — Not Always a Red Flag, But Still a Signal

The market hates promoter pledges.

But in the defence industry, pledges sometimes serve a more functional role — as collateral for bank guarantees and performance obligations on government contracts.

That said, Apollo’s ~35% pledge still signals dependence on short-term liquidity.

The management has promised to clear it “within six months.”

That’s a fair intent — but investors need clarity on how: will it come from internal cash, refinancing, or equity sale?

Transparency here isn’t cosmetic — it’s credibility.

IDL — A Strategic Loss Worth Owning

Apollo’s acquisition of Ideal Explosives Ltd. (IDL) drew mixed reactions.

On paper, it’s a loss-making company.

But strategically, it’s a masterstroke.

IDL gives Apollo direct control over ignition, fuse, and detonator components — a supply chain that most defence firms outsource.

It’s backward and forward integration — critical in a post-Atmanirbhar Bharat ecosystem where DRDO wants partners who can “own the full weapon chain.”

Yes, the short-term financials will look messy. But strategically, IDL’s inclusion could make Apollo one of the few private players capable of delivering end-to-end systems.

In defense, profitability is cyclical; capability is cumulative.

Margins: Compression Isn’t the Risk — Continuity Is

Apollo’s 28% EBITDA margin in Q2 FY26 made headlines.

But management acknowledged the mix: development orders carry high margins, while production contracts are lower.

That’s not a weakness — that’s the defence product life cycle.

Margins fall when production begins, but volume multiplies.

The real challenge isn’t sustaining margin — it’s sustaining the order flow.

If Apollo’s development work graduates into recurring production programs, its cash flows will stabilize.

If not, margins will vanish as projects reset.

Exports: The Waiting Game with a Hidden Advantage

Apollo mentioned ₹100 crore in export opportunities — all pending DRDO and MoD clearances.

That sounds like bureaucratic delay, but here’s the nuance:

exporting defence systems requires DRDO-origin certification.

Apollo already has that lineage, which means once approvals arrive, they can supply globally for years without revalidation.

So while short-term exports look dormant, long-term access is quietly compounding.

Funding Mix & Balance Sheet Pressure

Apollo’s debt stands around ₹335 crore; D/E ~0.55×.

Short-term borrowings (~₹250 crore) outweigh long-term (~₹38 crore).

Cash: ~₹20 crore.

For now, the numbers look manageable — but they lack cushion.

With defence receivables, one delayed payment can lock up a quarter’s worth of liquidity.

Apollo doesn’t have a solvency problem; it has a timing mismatch problem — the kind that never shows up in P&L, but defines the stock’s volatility.

Governance & Scaling — Where the Real Test Begins

Defence manufacturing is not just about production scale; it’s about process precision.

As a company moves from prototyping to large-scale assembly, every error — QA, vendor reliability, regulatory compliance — multiplies.

Apollo’s disclosures remain promoter-centric.

There’s no visible build-out of professional management, independent oversight, or digital ERP systems.

Scaling 8× without structural reinforcement is like increasing thrust without upgrading control systems.

They don’t need better PR.

They need stronger process engineering and financial governance.

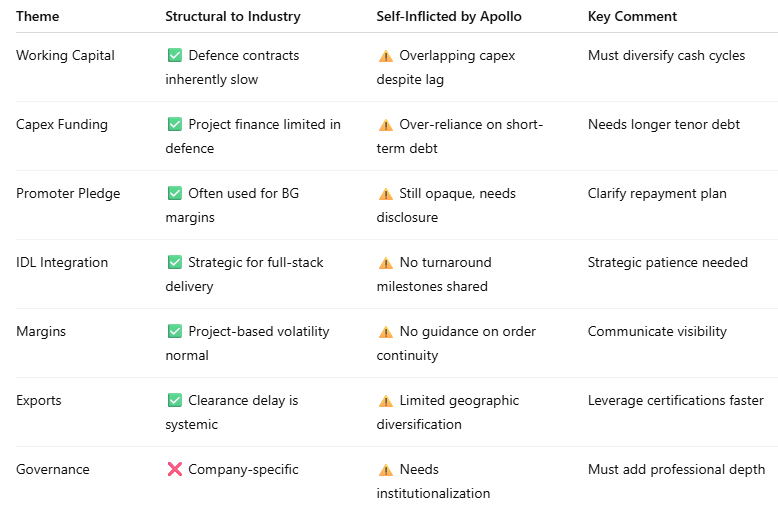

The Real Picture — Structural vs Self-Inflicted Risks

Tone Analysis: Maturity Emerging from Pressure

This management isn’t reckless; it’s reactive.

They’re not lying about their numbers — they’re optimistic within the constraints of an underdeveloped private defence ecosystem.

The tone of the Q2 call was confident, sometimes defensive, but not delusional.

It was the sound of a company trying to scale within a system that doesn’t scale easily.

Analyst’s Take

Apollo Micro Systems is not a hype stock.

It’s an authentic engineering company trying to professionalize inside India’s slowest-moving industrial segment.

Its risks are visible — cash flow, funding, pledge, structure — but most of them are timing and maturity issues, not fraud or fragility.

In defence, success doesn’t come from sprinting — it comes from outlasting the bureaucracy.

If Apollo stabilizes cash flows, integrates IDL, and commissions Unit 3 without overleveraging, it will graduate into the same league as Data Patterns and Paras Defence.

If it fails to institutionalize now, it risks becoming yet another mid-cap with a great idea and a broken balance sheet.

Apollo’s business runs on the DRDO clock; its stock trades on the NSE clock. The question is — which one will it listen to?

More from Dalal Street Lens

Most Investors Misread Accent Microcell. This Is the Real Business.

Most Investors Misread Accent Microcell. This Is the Real Business. Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In

Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In McDonald’s Business Model Explained: Why It’s Not Really About Burgers

McDonald’s Business Model Explained: Why It’s Not Really About Burgers Jesse Livermore Lessons

Jesse Livermore Lessons Karnataka Bank Earnings Call Analysis – November 2025

Karnataka Bank Earnings Call Analysis – November 2025 How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets

How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets Retail Investors vs Institutional Investors

Retail Investors vs Institutional Investors Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way

Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way Cost Structure Is Destiny

Cost Structure Is Destiny The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India

The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India