When Lionel Messi landed in India, it didn’t feel like a sporting event.

It felt like a moment.

Crowds. Cameras. Chaos. Headlines.

A few hours of presence, and weeks of noise.

To most people, this looked like football royalty blessing Indian soil.

To anyone watching closely, it looked like something else entirely.

This wasn’t football.

This was an attention trade.

And once you see it that way, the entire economics of celebrity events, and why Dalal Street keeps its distance, suddenly becomes clear.

Messi Isn’t the Business. Attention Is.

Here’s the uncomfortable truth most coverage misses:

Messi is not the product.

Attention is the product.

Messi is merely the source of attention — a powerful, scarce one, but the business revolves around how that attention is packaged, distributed, monetised, and risk-managed.

This single distinction explains:

- why organisers panic,

- why stars get paid first,

- and why public markets largely avoid this space.

Before going further, we need one simple mental model.

The Attention Value Chain

This is where the real story lies.

Step 1: Attention Creation

Who: Messi

Nature: Scarce, personal, globally recognisable

Risk: Zero

Step 2: Attention Control & Packaging

Who: Agents and management

What they sell: Appearance rights, image rights, time-bound access

Revenue type: Fixed

This is where the first cheque is written.

Step 3: Attention Distribution

Who: Event organisers, stadiums, platforms

Role: Bringing attention physically and digitally to consumers

Risk: Extremely high

Distribution is expensive, complex, and fragile.

Step 4: Attention Monetisation

Who: Organisers and partners

Revenue sources:

- Ticket sales

- Premium experiences

- Sponsorships

- Media clips

- Merchandise

Revenue here is variable, not guaranteed.

Step 5: Risk Absorption

If logistics fail, crowds turn hostile, or expectations are mismanaged, the organiser absorbs the damage —> financially and reputationally.

This is why chaos hurts promoters, not stars.

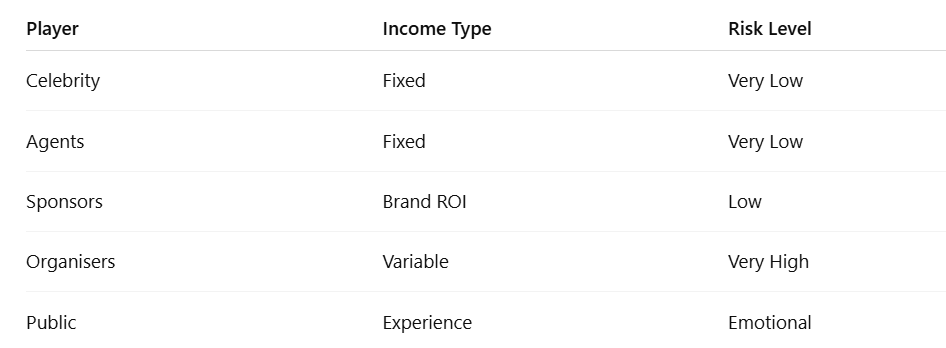

Who Gets Paid First, and Who Prays Last

In attention trades, payment order matters more than upside.

Fixed-Income Players

- Celebrities

- Agents

- Certain vendors

They are paid before the first ticket is scanned.

Variable-Income Players

- Event promoters

- Ticket-linked partners

They earn only if everything goes right.

Optionality Players

- Sponsors

- Media platforms

- Social networks

They gain visibility without execution risk.

Insight:

In volatile businesses, certainty beats upside.

Why This Is a Terrible Public Market Business

The obvious question now is:

If so much money is involved, why isn’t Dalal Street all over this?

Because structurally, this business fails public-market tests.

No Operating Leverage

Each event resets to zero.

No Repeatability

Attention decays the moment the event ends.

No Moat

Relationships are not defensible assets.

Asymmetric Risk

One bad night can wipe out years of goodwill.

This is why most large promoters stay private, and why listed markets prefer boring, scalable pipes over glamorous stages.

Then Where Does Dalal Street Actually Make Money?

Not at the event.

Around it.

Attention Pipes

- Media companies

- Streaming platforms

- Distribution networks

They monetise attention regardless of who creates it.

Attention IP

- Sports leagues

- Music catalogues

- Franchises

They don’t rent attention — they own it.

Platforms Over Performers

Platforms scale. Performers peak.

That’s why IPL franchises compound value, while one-off tours don’t.

India’s Live Events Future: What Will Change, What Won’t

What Will Grow

- Frequency of global tours

- Willingness to pay for experiences

- Brand-led events

What Will Remain Risky

- Crowd management

- Regulation

- Execution dependency

- Reputation sensitivity

What Would Need to Change for a Listed Giant to Emerge

- Long-term IP ownership

- Insurance depth

- Multi-year contracts

- Platform-level scale

Until then, this remains a high-glamour, high-risk private market game.

How to Read Event Headlines Like an Investor

Next time you see a flashy event headline, ask three questions:

- Who owns the attention?

- Who is renting it temporarily?

- Who gets paid even if things go wrong?

The answers will tell you everything you need to know.

FAQs

Is the celebrity event business profitable?

Sometimes, but profits are volatile and non-compounding.

Why are stars paid regardless of success?

Because they own the attention source.

Why aren’t there listed event promoters in India?

Because public markets dislike execution-heavy, reputation-sensitive models.

Can investors benefit from the live events boom?

Yes — indirectly, through media, platforms, and IP owners.

Final Thought: Owning the Switch, Not the Spotlight

In the attention economy, the loudest moment is rarely the most valuable one.

The real money isn’t made under the spotlight.

It’s made by those who own the switch that turns it on.

Once you see that, you’ll never read a celebrity headline the same way again.

Harsh is the creator of Dalal Street Lens, where he writes about investing, market behaviour, and financial psychology in a clear and easy way. He shares insights based on personal experiences, observations, and years of learning how real investors think and make decisions.

Harsh focuses on simplifying complex financial ideas so readers can build better judgment without hype or predictions.

You can reach him at imharshbhojwani@gmail.com

More from Dalal Street Lens

Most Investors Misread Accent Microcell. This Is the Real Business.

Most Investors Misread Accent Microcell. This Is the Real Business. Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In

Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In McDonald’s Business Model Explained: Why It’s Not Really About Burgers

McDonald’s Business Model Explained: Why It’s Not Really About Burgers Jesse Livermore Lessons

Jesse Livermore Lessons Karnataka Bank Earnings Call Analysis – November 2025

Karnataka Bank Earnings Call Analysis – November 2025 How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets

How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets Retail Investors vs Institutional Investors

Retail Investors vs Institutional Investors Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way

Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way Cost Structure Is Destiny

Cost Structure Is Destiny India’s Data Centre Supercycle: The Simplest Explanation of Colo, Cloud and AI Infrastructure

India’s Data Centre Supercycle: The Simplest Explanation of Colo, Cloud and AI Infrastructure