By Harsh Bhojwani

In Rocket Singh: Salesman of the Year (2009), Harpreet Singh doesn’t lack ambition — he lacks systems.

He sells hard, dreams harder, but his ledger doesn’t match his enthusiasm.

That’s what the market looks like when execution can’t keep pace with intent: a bright flame dimmed by its own oxygen hunger.

Indian Emulsifiers Ltd carries that same conflict — the optimism of a new-age manufacturer with the balance sheet discipline of an old trader.

It promised to be a next-generation specialty-chemical story, but what investors got was a fast-growing company still struggling to collect what it earns.

The performance that invited punishment

The company’s numbers looked cinematic at first glance.

Revenue leapt from ₹41 crore in FY23 to ₹101 crore in FY25 — a more-than-doubling act.

Profit margins stayed strong, near 20%, and management spoke of global ambitions, export subsidiaries, and innovation pipelines.

But then came the twist , not in the P&L, but in the cash flow statement.

Operating cash flow stood at –₹17 crore in FY25, while trade receivables and inventories ballooned to ₹30 crore and ₹36 crore respectively.

The market saw through the arithmetic.

The share price, once buoyed by optimism, began to tumble as investors realised the profits weren’t liquid — they were locked in warehouses and unpaid invoices.

Why this pattern keeps repeating

In India’s SME landscape, growth often arrives faster than governance.

Companies race to expand capacity, sign distributors, and announce subsidiaries, because those things are easy to showcase.

What’s harder to show, and even harder to fix, is working capital discipline.

And so, like Harpreet’s fictional startup, Indian Emulsifiers is not dishonest , just disorganised.

It’s not that it can’t generate cash; it’s that it hasn’t yet learned to demand it on time.

The market’s message is simple

The stock isn’t being punished for lack of growth — it’s being repriced for lack of control.

In chemical manufacturing, rapid scaling without operational grip isn’t strategy — it’s leakage.

Cash flow is not a financial metric; it’s a moral one. It reveals who gets paid first — the company, or its customers.

Inside the Numbers: When Profits Lie and Cash Speaks

For most people, a company’s profit and loss statement feels like the whole story — a linear script that begins with sales and ends with applause.

But real investors know the truth hides backstage, in the cash flow statement.

That’s where you find out if the standing ovation was paid for with borrowed applause.

In FY25, Indian Emulsifiers reported a profit of ₹13.3 crore — respectable, even exciting, for a company barely five years old.

But the cash flow statement told a different story.

Operating cash stood at –₹17 crore, meaning that even as profits grew, actual liquidity was shrinking.

Receivables tripled, inventories more than doubled, and the gap between accounting income and real inflow widened like a crack beneath polished tiles.

This is where financial storytelling meets behavioural psychology.

Most small-cap managements — especially those fresh off IPOs — chase revenue optics.

Topline growth feeds confidence. It looks heroic on a presentation slide.

But when every rupee of revenue takes four months to collect, and every finished good sits in inventory longer than the company can afford, the business isn’t compounding — it’s congesting.

To put it simply: Indian Emulsifiers isn’t short of orders. It’s short of oxygen.

And the market, which once clapped for growth, now waits for breath.

The silent killers inside the balance sheet

Working capital is the quietest form of risk.

It doesn’t show up in headlines. It creeps in through “sundry debtors” and “inventory buildup,” the polite euphemisms of financial reports.

But over time, it strangles cash generation, forces short-term borrowing, and leaves companies funding operations with yesterday’s optimism.

In FY23, Indian Emulsifiers had ₹8 crore tied up in receivables. By FY25, that number had soared past ₹30 crore.

Inventory followed the same trajectory — ₹8 crore to ₹36 crore.

That’s ₹58 crore locked inside the balance sheet — more than 55% of annual revenue — waiting to become cash.

This isn’t theft or fraud. It’s financial immaturity.

It’s what happens when ambition outruns systems — when the hunger to grow becomes the habit of waiting to get paid.

Why profits can lie

Profits are an opinion.

Cash is a fact.

A company can show rising earnings simply by selling more on credit or delaying payments to suppliers.

But markets are not fooled forever.

Eventually, they start valuing the reliability of inflow more than the quantum of income.

That’s what’s happening here — the market isn’t calling Indian Emulsifiers a failure; it’s pricing in a lesson.

What Serious Investors Should Watch Next

If Indian Emulsifiers wants to reclaim the market’s faith, it must shift from expansion mode to execution mode.

The next twelve months will decide whether this company matures into a genuine specialty-chemical player or stays another SME headline.

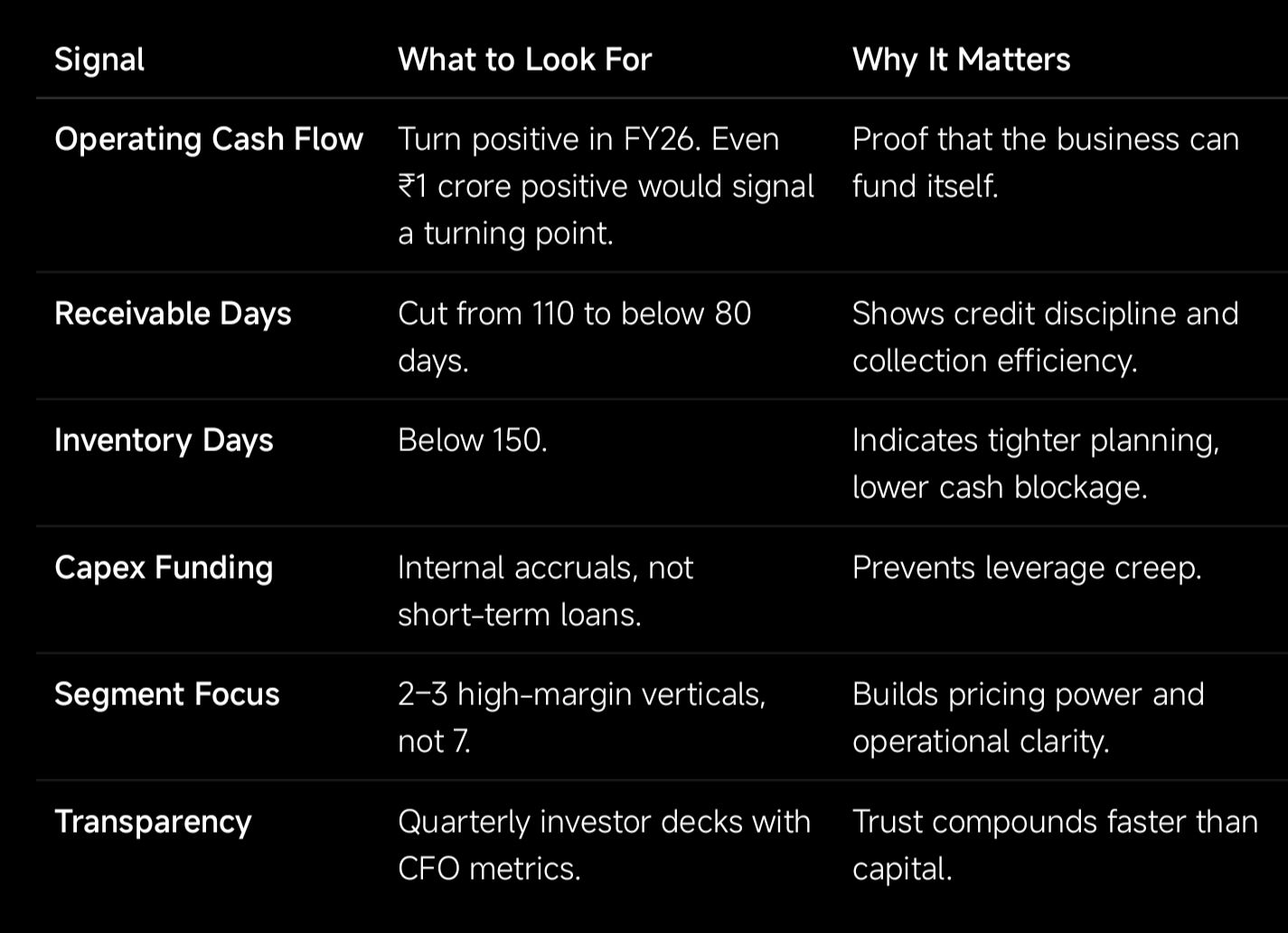

Here’s what serious investors should watch not in presentations, but in numbers:

The arc of accountability

Markets forgive early mistakes.

What they don’t forgive is repetition.

If Indian Emulsifiers learns to treat cash as the real measure of performance, it can still evolve from a story stock into a serious compounder.

The demand is real, the technology is proven, and the runway is long, but none of it matters until the rupees arrive on time.

For now, the verdict is clear:

The company has conviction.

The market has calculation.

One must meet the other halfway — in cash.

More from Dalal Street Lens

Most Investors Misread Accent Microcell. This Is the Real Business.

Most Investors Misread Accent Microcell. This Is the Real Business. Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In

Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In McDonald’s Business Model Explained: Why It’s Not Really About Burgers

McDonald’s Business Model Explained: Why It’s Not Really About Burgers Jesse Livermore Lessons

Jesse Livermore Lessons Karnataka Bank Earnings Call Analysis – November 2025

Karnataka Bank Earnings Call Analysis – November 2025 How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets

How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets Retail Investors vs Institutional Investors

Retail Investors vs Institutional Investors Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way

Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way Cost Structure Is Destiny

Cost Structure Is Destiny The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India

The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India