For a long time, I thought McDonald’s was simple.

It sells burgers.

Cheap, fast, familiar burgers.

That explanation felt complete. You eat there, you leave, and you don’t think about it again. I assumed there wasn’t much depth hiding behind a counter and a paper bag.

That belief held up, until I tried to understand why McDonald’s has lasted for decades, while most restaurant chains quietly disappear.

Popularity explains attention.

It doesn’t explain survival.

The standard explanation of McDonald’s business model

Most explanations of McDonald’s business model sound reasonable.

McDonald’s simplified food. It standardized kitchens. It trained people to follow repeatable processes. Then it franchised this system aggressively. More outlets meant more customers, stronger brand recall, and higher revenue.

This explanation isn’t wrong. It describes what customers see and what franchisees experience.

But it explains growth, not durability.

Where this explanation actually works

At the level of a single outlet, the logic holds.

Margins are thin — often around 5–8% for the franchisee — but volume compensates. A busy McDonald’s can serve thousands of customers every day. The menu is short. Waste is controlled. Speed is optimized.

If you stand inside a McDonald’s and observe, nothing looks fragile. Orders move quickly. People don’t hesitate. The system feels reliable.

That’s why the surface explanation feels complete.

The question that changes the frame

The uncomfortable question is this:

Why has McDonald’s survived for more than 80 years in a fragile industry?

Restaurants face rising wages, food inflation, rent pressure, and changing tastes. Most chains don’t fail dramatically, they slowly lose relevance.

McDonald’s didn’t.

That’s where the burger-based explanation starts to break.

The hidden assumption

Without realizing it, I was assuming that McDonald’s long-term strength comes from selling food well.

But selling food and capturing value are not the same thing.

And this is where McDonald’s business model quietly shifts categories.

The shift most people miss

At some point, McDonald’s stopped focusing only on what it sold and started focusing on where it sold.

Who owns the land?

Who controls the location?

Who gets paid even when the restaurant struggles?

Those questions don’t appear on menus.

But they decide who survives.

A simple diagram that explains McDonald’s business model

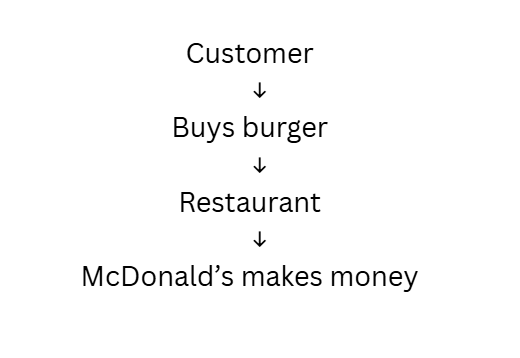

What most people think is happening

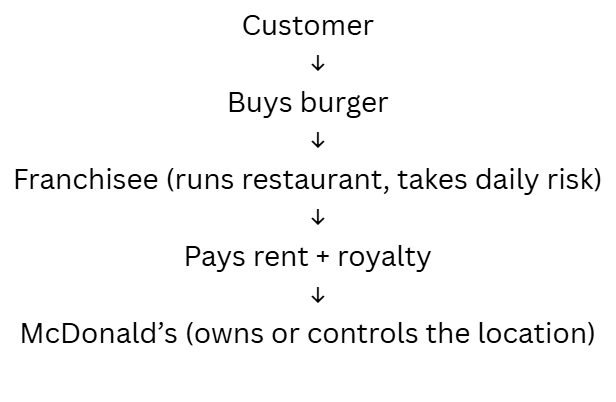

What is actually happening

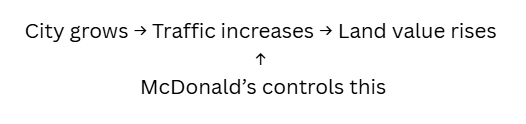

And quietly, over time:

The burger brings people.

The location keeps the value.

What McDonald’s business model looks like underneath

McDonald’s has 40,000+ restaurants globally.

More than 90% are operated by franchisees.

In many cases, McDonald’s:

- Owns the land, or

- Controls long-term leases

The franchisee:

- Manages staff

- Pays salaries

- Handles food inflation

- Deals with daily operational stress

McDonald’s:

- Collects rent

- Collects royalties linked to sales

- Retains control over the site

If one operator fails, the location usually doesn’t.

That’s the structural core of McDonald’s business model.

📌 Beginner Investor Lens

If you’re new to investing, pause here.

When we study companies, we usually focus on:

- Products

- Popularity

- Revenue growth

McDonald’s teaches a quieter lesson:

Ask who gets paid first — and who carries the risk.

McDonald’s shareholders are not exposed to:

- Daily staffing problems

- Kitchen efficiency

- Food wastage

Those risks sit with franchisees.

Instead, the company earns from:

- Rent

- Royalties

- Long-term contracts

- Locations that quietly appreciate over time

For beginners, this shift in thinking matters.

Don’t just ask:

“Is this a great product?”

Also ask:

“Does this business earn even when things go wrong?”

That’s where durability lives.

A small fact that changes perspective

In several years, a large share of McDonald’s operating profit came from rent and royalties, not from selling food directly.

Another detail most people miss:

Many McDonald’s locations were bought decades ago, when land near highways and city edges was cheap. Cities later expanded around them.

Menus changed.

Locations stayed valuable.

Why McDonald’s business model is often misunderstood

We focus on what’s visible.

Menus are visible.

Ads are visible.

Counters are visible.

Leases are boring.

Land ownership is silent.

But silence is often where long-term advantage hides.

The uncomfortable but honest conclusion

I no longer think McDonald’s won because it made better burgers.

It won because it understood something deeper:

If you control the place where demand reliably gathers, you don’t have to win every day. You just have to last.

That insight explains McDonald’s business model better than any menu ever could.

Harsh is the creator of Dalal Street Lens, where he writes about investing, market behaviour, and financial psychology in a clear and easy way. He shares insights based on personal experiences, observations, and years of learning how real investors think and make decisions.

Harsh focuses on simplifying complex financial ideas so readers can build better judgment without hype or predictions.

You can reach him at imharshbhojwani@gmail.com

More from Dalal Street Lens

Most Investors Misread Accent Microcell. This Is the Real Business.

Most Investors Misread Accent Microcell. This Is the Real Business. Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In

Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In Jesse Livermore Lessons

Jesse Livermore Lessons Karnataka Bank Earnings Call Analysis – November 2025

Karnataka Bank Earnings Call Analysis – November 2025 How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets

How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets Retail Investors vs Institutional Investors

Retail Investors vs Institutional Investors Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way

Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way Cost Structure Is Destiny

Cost Structure Is Destiny The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India

The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India India’s Data Centre Supercycle: The Simplest Explanation of Colo, Cloud and AI Infrastructure

India’s Data Centre Supercycle: The Simplest Explanation of Colo, Cloud and AI Infrastructure