Shanti Gold International has quickly become one of the most talked-about companies in the jewellery manufacturing space. With rising revenues, a successful IPO, strong ROE and rapid expansion, the company looks exciting at first glance.

But beneath the surface lie deeper questions about margins, cash flow, receivables, scalability and the true strength of its moat.

This blog brings together every important question an investor should ask — and the answers that matter.

What Does Shanti Gold International Actually Do?

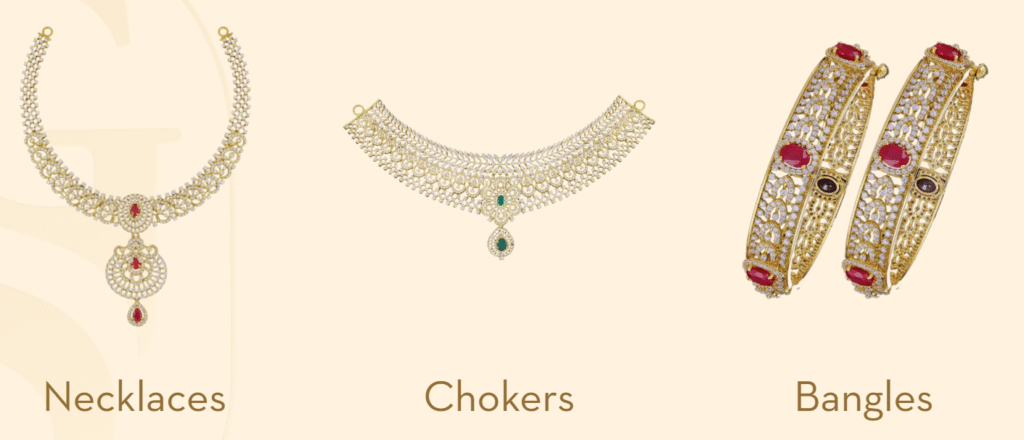

Shanti Gold is a B2B manufacturer of 22-karat gold jewellery, specialising in CZ-casting jewellery — gold jewellery studded with cubic zirconia stones (not diamonds), produced using precision casting.

They do not sell to end-customers.

Their clients are:

- Large jewellery chains (Joyalukkas, Lalithaa, Alukkas)

- Wholesalers

- Export buyers

- Distributors

Their strength lies in fast-moving, design-heavy jewellery with very quick turnaround times.

Do Customers Know They’re Buying CZ and Not Diamonds?

Yes.

The company openly markets itself as a producer of 22k CZ casting gold jewellery. Retailers are expected to communicate the same to their consumers.

There is no concealment — CZ is a globally accepted diamond alternative — but the business relies heavily on premium finishing, consistent quality, and trust.

Where Does Shanti Gold Fit in the Jewellery Value Chain?

Upstream (Areas They Do Not Control)

- Gold price volatility

- Global gold supply chain

- CZ stone supply

- Currency fluctuations

Midstream (Areas They Control Strongly)

- In-house manufacturing

- Casting, designing, finishing

- Quality control

- Speed of production

- Trend-aligned design creation

- B2B fulfilment and delivery discipline

- Customer relationships

Downstream (Limited Control)

- Retailer pricing

- Consumer preferences

- Seasonal / regional demand

- Retailer shelf placement

Their real power lies in design + manufacturing + B2B relationships, not in retail branding.

What Is the Real Moat of This Company?

a) Rapid Design-to-Delivery Engine

They release new designs every few weeks and convert concepts into finished jewellery faster than most competitors.

b) Strong B2B Relationships

Large retailers trust suppliers who deliver consistently. Reliability creates switching cost.

c) Skilled Labour + Scale

Casting + CZ setting requires years of trained hands — not easy to copy.

d) High Working-Capital Handling Ability

Gold inventory + receivables require significant liquidity. Only experienced operations can manage this.

e) Niche Specialisation

22k CZ-casting jewellery is a niche in the industry with comparatively fewer large-scale players.

How Hard Is It for New Players To Enter This Segment?

Moderately difficult.

Machines can be purchased.

Skill cannot.

Relationships cannot.

New entrants struggle with:

- Design speed

- Finishing consistency

- Timely deliveries

- Consumer-region specific designs

- Working-capital discipline

This gives Shanti Gold a time-based operational moat.

Management Credibility — What We Know

Positives

- 20+ years of domain experience

- Clear disclosures

- Strong promoter alignment

- Steady execution track record

Concerns

- High working-capital dependence

- Heavy promoter control

- Governance will be tested as they scale

- Cash generation not matching accounting profit

Credit Ratings — What They Reveal

Recent rating: IVR BBB+ (Stable) and A2 (Short-term).

Meaning:

- Good repayment ability

- Moderate overall risk

- Improvement seen in financial structure

- But high working-capital intensity remains a material concern

Are Their Profits Real or Just Paper Profits?

This is where investors must look closely.

PAT Growth (Looks Excellent)

- FY23: ~₹19.8 cr

- FY24: ~₹26.8 cr

- FY25: ~₹55.8 cr

Operating Cash Flow (Tells a Different Story)

- FY23: –₹3.5 cr

- FY24: –₹12.5 cr

- FY25: –₹15.3 cr

Despite rising profits, cash from operations is consistently negative.

Cash Trapped in the System

- Receivables: ~₹182 cr

- Inventory: ~₹149 cr

- Working-capital cycle: ~109 days

Much of the “profit” is stuck inside the business — not turning into cash.

This is the biggest weakness in Shanti Gold today.

How Are They Funding the Jaipur Expansion?

Not through internal cash.

They are funding it through IPO proceeds, where ~₹45–46 crore is allocated for the new manufacturing facility.

This shows that internal cash flow is not strong enough to support expansion independently.

Peer Comparison — What Do the Numbers Reveal?

Peers Chosen

- Goldiam International (closest peer — jewellery manufacturing + export)

- PC Jeweller (hybrid — manufacturing, wholesale, retail)

Asset Turnover

- Shanti Gold: ~2.75× (very high)

- Goldiam: ~0.96×

- PCJ: ~0.29×

Shanti Gold is extremely efficient in asset utilisation.

Equity Multiplier (Leverage)

- Shanti Gold: ~2.6×

- Goldiam: ~1×

- PCJ: ~1.2×

Higher leverage boosts ROE — but increases risk.

Margins (PAT)

- Shanti Gold: ~5%

- Goldiam: ~15–18%

- PC Jeweller: 20%+

Shanti Gold operates on thinner margins than peers.

Top Questions Investors Should Ask Management

Q1) What is your concrete plan to reduce receivable days and inventory days?

What we expect:

- Clear targets (e.g., 109 days → 75 days)

- Customer-wise credit limits

- Incentivised early payment

- Stricter dispatch rules

Q2) How will you convert accounting profit into cash profit over the next 2–3 years?

Expected answer:

- Better credit controls

- Tighter supply chain

- Vendor-day optimisation

- Improved production scheduling

Q3) What PAT margin do you realistically target post-Jaipur expansion?

Expected answer:

- Concrete guidance (e.g., 6–8% in 2 years)

- Operating-efficiency roadmap

These answers reveal how strategically mature the management truly is.

What Should Shanti Gold Do Right Now To Improve Receivables & Cash Flow?

This is the most important actionable section.

a) Enforce Stricter Credit Terms

High-value B2B customers must be categorised by risk.

Actions:

- Reduce credit period for slow-paying clients

- Offer discounts for early payments

- Stop dispatches beyond approved limits

b) Implement Customer-Level Credit Scorecards

Track:

- Payment behaviour

- Return rates

- Order cancellations

- Annual business volume

Use this to prioritise which customers deserve credit.

c) Reduce Inventory Through Production Discipline

Actions:

- Move to demand-based production

- Reduce SKUs that have low turnaround

- Introduce weekly inventory audits

d) Tighten Dispatch-to-Collection Cycle

Link dispatch to:

- 50% advance or

- Shorter receivable terms for smaller buyers

e) Leverage Technology for Cash Forecasting

Use ERP systems for:

- Live receivable ageing

- Cash-flow alerts

- Inventory turnover analytics

f) Negotiate Payment Terms with Suppliers

Extend vendor credit by 10–15 days to reduce cash strain.

g) Appoint a Dedicated Cash-Flow Controller

Someone whose only job is to monitor collections, customer behaviour and daily cash flow.

These changes can bring positive operating cash flow within 2–4 quarters.

True Valuation — Fair, Cheap, or Expensive?

Current Multiples

- P/E ~17–18×

- P/B ~3×

Given ROE (~36–45%) and growth, the valuation is reasonable but not deeply undervalued.

Upside Case (If They Fix Cash Flow + Improve Margins)

P/E can rise to 20–25×

Valuation rerating possible.

Downside Case (If Cash Flow Weakness Continues)

P/E may drop to 12–15×

Verdict

The stock is fairly valued with upward potential if execution improves.

Final View — Should You Track This Company?

Yes — because Shanti Gold is at an inflection point.

Strengths

✔ Strong growth

✔ High ROE

✔ Niche manufacturing focus

✔ Fast design cycles

✔ Deep B2B relationships

✔ Efficient asset utilisation

Risks

✘ Cash flow mismatch

✘ High receivables + inventory

✘ Low margins compared to peers

✘ Leverage risk

✘ Execution risk in new facility

Bottom Line

Shanti Gold could become a high-quality compounder only if it fixes its cash-flow and margin structure.

Otherwise, it risks remaining a high-ROE, low-cashflow trap.

If you liked this blog, you might enjoy my previous one as well:

👉 Strong USD Is Not a Modi Issue or a Congress Issue — It’s Global

Harsh is the creator of Dalal Street Lens, where he writes about investing, market behaviour, and financial psychology in a clear and easy way. He shares insights based on personal experiences, observations, and years of learning how real investors think and make decisions.

Harsh focuses on simplifying complex financial ideas so readers can build better judgment without hype or predictions.

You can reach him at imharshbhojwani@gmail.com

More from Dalal Street Lens

Most Investors Misread Accent Microcell. This Is the Real Business.

Most Investors Misread Accent Microcell. This Is the Real Business. Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In

Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In McDonald’s Business Model Explained: Why It’s Not Really About Burgers

McDonald’s Business Model Explained: Why It’s Not Really About Burgers Jesse Livermore Lessons

Jesse Livermore Lessons Karnataka Bank Earnings Call Analysis – November 2025

Karnataka Bank Earnings Call Analysis – November 2025 How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets

How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets Retail Investors vs Institutional Investors

Retail Investors vs Institutional Investors Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way

Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way Cost Structure Is Destiny

Cost Structure Is Destiny The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India

The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India

Pingback: Narayana Health Q2 Concall Explained — The 7 Big Insights Every Investor Should Know - Dalal Street Lens

Pingback: Why Cheap Stocks Trap You — The Psychology Behind It - Dalal Street Lens