1. India Panicked. Aviation Finally Got Interesting.

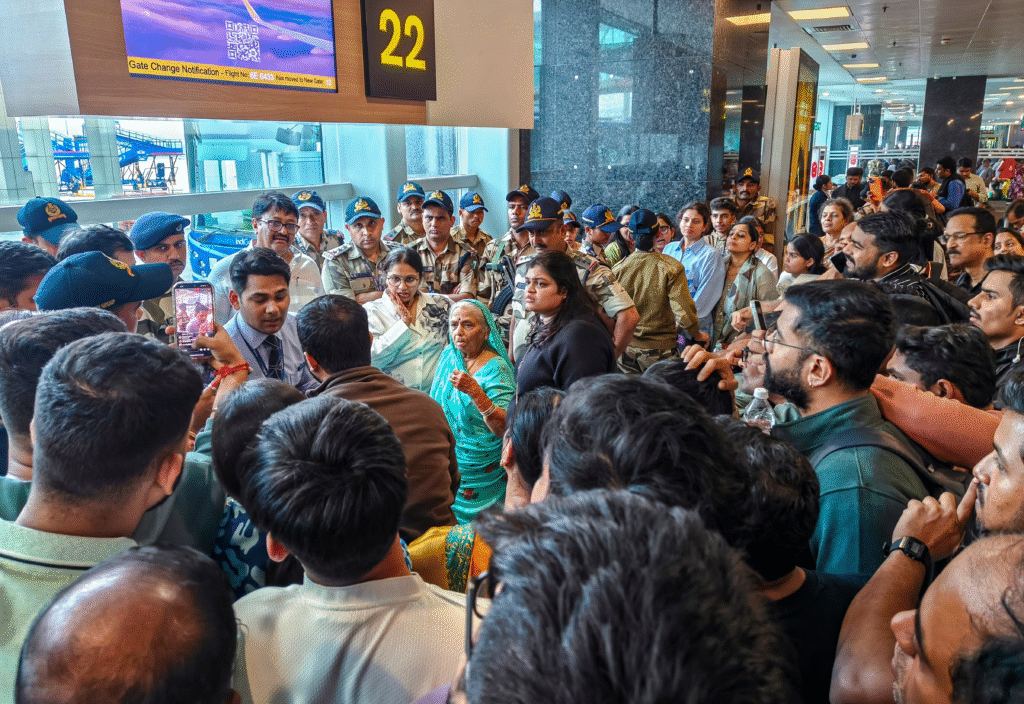

IndiGo cancelled flights.

Passengers erupted.

News channels prepared their favorite dish: aviation conspiracy biryani.

Twitter demanded the CEO’s horoscope.

But behind the noise, a deeper truth was waiting to be noticed:

This wasn’t IndiGo’s crisis.

This was India’s aviation industry sending a distress flare.

If you looked closely, the message was clear:

“We’ve been running on borrowed time.”

2. The US Has Seen This Movie Before — And the Ending Was Spectacular

In 2009, the FAA tightened pilot-rest rules.

US airlines behaved exactly like Indian passengers at T3 last week: confused, angry, jetlagged… without ever flying.

The impact?

- Cancellations

- Chaos

- Small airlines collapsing

- Large airlines consolidating

And then…

something beautiful happened.

US aviation became profitable.

For the first time in history.

Margins stabilized, fares rose, and the Big Four created a comfortable oligopoly.

India right now is not in a meltdown

we are in the American aviation flashback.

3. The IndiGo Fiasco Exposed the Truth India Wanted to Ignore

People think we have a “pilot shortage.”

Cute.

The real issue is Commander shortage

the senior pilots who actually run the show.

Upgrading a First Officer into a Commander takes 5–7 years.

And India has been expanding aviation like a kid inflating a balloon while ignoring the air pump’s capacity.

When rest rules tightened, the balloon didn’t burst

it simply reminded everyone physics exists.

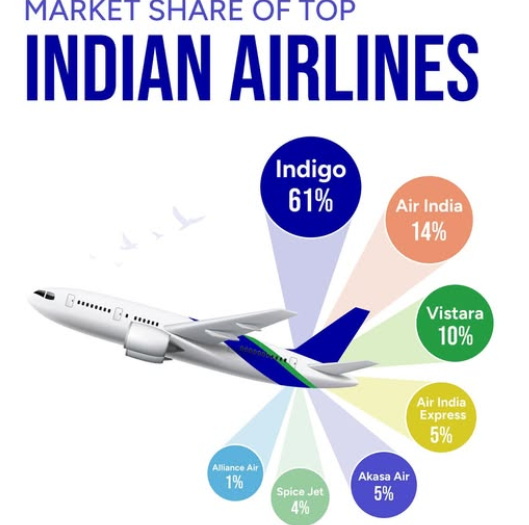

4. How IndiGo Became the Reluctant Maharaja of Indian Skies

IndiGo didn’t become dominant by accident.

- One aircraft type

- Ruthless cost discipline

- Gigantic aircraft orders placed early

- Zero drama

- Clinical operations

- Competitors self-destructing more frequently than FTX-inspired crypto projects

And the true masterstroke?

Slots.

Delhi. Mumbai. Bengaluru.

International investors call these “airport bottlenecks.”

I call them:

“assets no government, no competitor, and no divine intervention can create overnight.”

IndiGo owns these slots like a landlord who refuses to sell the ancestral home.

5. Should Investors Panic? The Correct Answer Is “Not Unless You Panic at ATMs Too.”

Aviation, by design, has bad quarters.

It’s as cyclical as Indian political alliances.

But long-term investing is about structure, not turbulence.

And structurally?

India is repeating the US aviation evolution with embarrassing accuracy.

This is not the time to panic.

This is the time to observe which airlines can survive a regulatory punch without fainting.

Spoiler: not many.

6. The New Rest Rules: Everyone Suffers, but Not Equally

IndiGo will take a hit:

- more pilots

- higher salaries

- lower aircraft utilisation

Yes, margins will drop by 300–500 basis points.

Yes, profits will take a ₹2,000+ crore hit.

But here’s the part analysts often miss:

When costs rise, the strong raise fares.

The weak raise excuses.

Small airlines lose their best passengers first.

It’s called Yield Bifurcation, a fancy way of saying:

“premium travellers don’t enjoy experiments.”

7. The US Airline Clean-Up: A Perfect Blueprint for India

The US saw the same phenomenon:

- Regulations tightened

- Costs jumped

- Small airlines collapsed

- Larger ones strolled into a decade of comfort

India is heading there.

And the speed at which we arrive depends on how quickly the weakest links tire out.

Which brings us to the question you were already thinking…

8. Which Airlines Survive the Indian Hunger Games?

High Risk:

SpiceJet — surviving on luck, prayers, and occasional government sympathy.

AIX — integration stress + crew unrest = turbulence forecast.

Medium Risk:

Akasa — well-run but too small to win a cost war.

Low Risk:

Vistara — good brand, complicated timelines.

Strong:

Air India — access to capital, global ambition.

Unshakeable:

IndiGo — dominant, disciplined, and depressingly predictable in its efficiency.

But here’s the twist nobody talks about:

Air India’s international expansion will drain talent from every other airline.

Commanders will migrate.

Training staff will migrate.

Engineers will migrate.

Indigo will lose some.

Others will lose survival.

9. The Structural Tsunami Behind the Industry’s Future

These are not temporary issues.

These are decade-shaping forces:

• Commander shortage → fares rise

• Slot scarcity → moat deepens

• Aircraft supply lag → demand > supply

• Regulation → small players break first

• Training bottlenecks → slow upgrades

• Aircraft induction race → IndiGo wins by miles

• Pricing power → permanently higher

If you read this list and feel calm, congratulations:

you understand aviation better than many junior level analysts.

10. Welcome to India’s New Duopoly

You are witnessing the birth of a market structure:

IndiGo dominates domestic.

Air India dominates international.

Everyone else fights for relevance.

This is not a guess.

This is the outcome of:

- regulation

- economics

- scale

- infrastructure

- talent migration

It is destiny wearing a uniform and carrying a flight bag.

11. Within This Duopoly, IndiGo Will Still Win More

IndiGo owns:

- Slot real estate

- A pilot pipeline

- A training ecosystem

- A mega order book

- Ridiculous cost leadership

- Frequency advantage

- Customer trust

- And the killer advantage: the ability to induct 50–60 aircraft every year without choking.

Competitors can’t even fill their HR department without delays.

IndiGo grows with the demand curve.

Others grow with PowerPoint slides.

12. And Then There’s the Silent Margin Bomb: ATF Under GST

If ATF ever comes under GST,

airlines get a margin reset moment.

Two to four percentage points of margin expansion —

without lifting a finger.

This is aviation’s equivalent of a cheat code.

And guess who benefits the most?

The airline that flies the most.

IndiGo.

13. Final Investor Takeaway

Short-term panic? Sure.

Long-term clarity? Absolutely.

You are not watching an airline collapse.

You are watching an industry evolve.

Crisis → consolidation → duopoly → profitability.

The US lived this story.

India is now the main character.

And IndiGo?

It’s not the victim.

It’s the one airline that will walk out stronger than it entered.

IndiGo’s meltdown wasn’t aviation falling apart, it was aviation falling into place.

If you liked this blog, you might enjoy my previous ones as well:

👉 Why Cheap Stocks Trap You — The Psychology Behind It

👉Why Nifty Is at All Time Highs but Your Portfolio Is in the Basement

👉AI Won’t Crash Like 2000. It Might Correct Like 2008 — When Reality Finally Shows Up.

👉Strong USD Is Not a Modi Issue or a Congress Issue — It’s Global

👉 Why We Feel Smarter After a Stock Falls: The Psychology of Market Regret

👉 Why Comparing Your Portfolio to Others Destroys Your Returns

👉Is Your Stock a Hidden Pump-and-Dump?

Harsh is the creator of Dalal Street Lens, where he writes about investing, market behaviour, and financial psychology in a clear and easy way. He shares insights based on personal experiences, observations, and years of learning how real investors think and make decisions.

Harsh focuses on simplifying complex financial ideas so readers can build better judgment without hype or predictions.

You can reach him at imharshbhojwani@gmail.com

More from Dalal Street Lens

Most Investors Misread Accent Microcell. This Is the Real Business.

Most Investors Misread Accent Microcell. This Is the Real Business. Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In

Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In McDonald’s Business Model Explained: Why It’s Not Really About Burgers

McDonald’s Business Model Explained: Why It’s Not Really About Burgers Jesse Livermore Lessons

Jesse Livermore Lessons Karnataka Bank Earnings Call Analysis – November 2025

Karnataka Bank Earnings Call Analysis – November 2025 How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets

How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets Retail Investors vs Institutional Investors

Retail Investors vs Institutional Investors Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way

Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way Cost Structure Is Destiny

Cost Structure Is Destiny The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India

The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India