By Harsh Bhojwani

A decade ago, The Leela Palaces & Resorts looked like a diamond-studded ship taking on water. Its hotels gleamed with marble and chandeliers, but beneath the surface was a ballast of debt so heavy that even the grandeur couldn’t keep it afloat.

The company had borrowed to build India’s most opulent hotels, from Udaipur’s shimmering lakefront palace to Delhi’s glass-wrapped luxury fortress. But the cash never flowed fast enough to service the loans. Interest bills climbed higher than occupancy. What had begun as a family dream was sinking into a financial nightmare.

By 2017, The Leela was in bankruptcy court. Its rooms were full, but its books were empty.

When the Father Walked In

In 2019, salvation arrived, not in a maharaja’s carriage but through a Canadian fund’s balance sheet.

Brookfield Asset Management, the global investment giant, stepped in to acquire The Leela brand, four key hotels, and management rights for about ₹3,950 crore.

They didn’t just buy a hospitality company, they bought a legacy, and a mess.

Within months, Brookfield did what few families can: separated emotion from enterprise. They cleared Leela’s debt, cleaned the books, and rebuilt the company like an institutional project, not a personal passion.

In the words of one analyst, “Brookfield didn’t rescue a hotel chain, it rescued a beautiful brand from a bad balance sheet.”

The Shift, From Dreams to Discipline

Before Brookfield, The Leela was all heart. After Brookfield, it became a brain with a heartbeat.

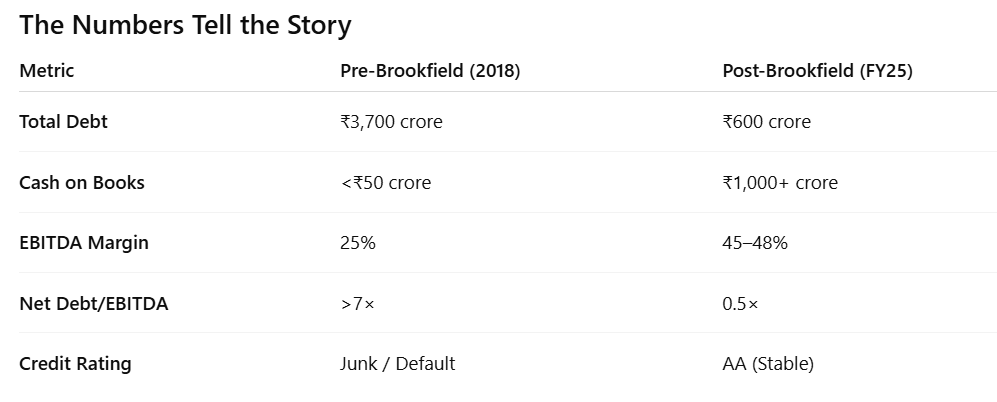

Debt of over ₹3,700 crore was replaced by clean equity. Interest costs fell by nearly 85 percent.

The company that once borrowed at 12 percent now keeps ₹1,000 crore of cash on its books.

The new management, led by CEO Anuraag Bhatnagar and CFO Ravi Shankar, replaced lavish instinct with institutional control. Budgets became sacred, board approvals replaced family nods, and “Build at any cost” became “Build only if it compounds.”

The Leela stopped buying palaces and started managing them.

A New Business Model, The Father and Son Analogy

The best way to understand the new Leela is this:

The father buys the shop, the son runs it.

Brookfield, the father, brings deep pockets and patience. It owns the hotels, funds expansion, and ensures long-term value.

The Leela, the son, brings craft, brand, and soul. It runs the hotels, trains the staff, designs the guest experience, and earns management fees.

Brookfield doesn’t lend to Leela, it partners with it.

Leela doesn’t build for Brookfield, it operates for it.

It’s a relationship built not on dependence, but on alignment.

The Leela now converts 70 percent of EBITDA into cash, one of the best ratios in Indian hospitality.

It earns ₹360 to ₹400 crore annually in operating cash flow, enough to fund new hotels without borrowing.

The Expansion, Luxury with Liquidity

Earlier, expansion meant more debt.

Now, expansion means partnerships and cash discipline.

Take the new Leela Palace Dubai:

- A 546-key property on Palm Jumeirah

- 75 percent owned by Brookfield, 25 percent by Leela

- Entirely funded from Leela’s internal cash

- Expected 17 percent yield on cost and 2 to 3-year equity payback

- Non-recourse debt, meaning Leela’s main balance sheet stays untouched

Or the upcoming Leela Palace BKC, Mumbai:

- A ₹800 crore project, 100 percent hotel-only after dropping the office component

- Focused capital, better returns, same financial discipline

This isn’t reckless ambition. It’s measured scale, the mark of a company that remembers where it came from.

Cash is the New Luxury

Today, The Leela sits on ₹1,000 crore of liquidity, more than some listed hotel chains earn in annual revenue.

Its debt-to-equity ratio is 0.2×.

It earns as much from treasury income (interest on surplus cash) as it once paid out in bank charges.

The company has transformed its financial identity:

Earlier, it borrowed to build palaces.

Now, it builds palaces from cash.

That single inversion tells you everything about the new Leela.

The Broader Lesson

Leela’s revival isn’t just about hotels. It’s a case study in modern capitalism done right.

It shows how institutional capital and heritage brands can coexist, one brings patience, the other brings passion.

For Brookfield, Leela isn’t a trophy, it’s a platform.

For Leela, Brookfield isn’t a crutch, it’s a compass.

The father still buys the shop, yes.

But the son now runs it like a CEO, not a dreamer.

The Leela of 2025

- 13 operating hotels, expanding to 20-plus in 3 years

- ₹2,000 crore EBITDA target by FY30

- Global expansion led by Dubai

- 70 percent EBITDA-to-Cash conversion

- A brand that no longer fights debt, it compounds liquidity

In the end

It’s rare to see a company retain its soul while changing its DNA. Leela has done both.

Luxury, it turns out, isn’t chandeliers and marble anymore.

It’s liquidity, governance, and the peace of mind that comes when you can build without borrowing.

This article is intended solely for educational and informational purposes. It is not investment advice or a recommendation to buy or sell shares of any company mentioned.

More from Dalal Street Lens

Most Investors Misread Accent Microcell. This Is the Real Business.

Most Investors Misread Accent Microcell. This Is the Real Business. Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In

Costco Business Model Explained: Why Costco Feels Different the Moment You Walk In McDonald’s Business Model Explained: Why It’s Not Really About Burgers

McDonald’s Business Model Explained: Why It’s Not Really About Burgers Jesse Livermore Lessons

Jesse Livermore Lessons Karnataka Bank Earnings Call Analysis – November 2025

Karnataka Bank Earnings Call Analysis – November 2025 How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets

How Nassim Taleb’s Trading Philosophy Changed the Way I Look at Confidence in Markets Retail Investors vs Institutional Investors

Retail Investors vs Institutional Investors Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way

Second Order Thinking in Investing: Four Decisions I Had to Learn the Hard Way Cost Structure Is Destiny

Cost Structure Is Destiny The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India

The Attention Economy Trade: Who Really Makes Money When Global Stars Visit India